Hey there, fellow cinephiles! While we usually dive into the latest flicks or behind-the-scenes gossip, today we’re stepping into a fascinating discussion about investing. Yes, believe it or not, the world of finance can be as riveting as your favorite cult classics. Sheffield Financial brings us exceptional insights on investment strategies, and who knows? You might just find ways to build that blockbuster portfolio you’ve always dreamed of!

So grab some popcorn, settle in, and let’s explore Sheffield Financial’s top investment strategies for 2026. Whether you’re swooning over a heartwarming romantic comedy or gushing about a mind-bending sci-fi thriller, you’ll want to stay tuned for these golden nuggets of financial wisdom.

Top 7 Sheffield Financial Investment Strategies for 2026

Investors in 2026 are constantly seeking innovative ways to enhance their portfolios, and Sheffield Financial has pinpointed several standout strategies that capitalize on current market trends. Here are the top seven investment strategies recommended by Sheffield Financial this year:

1. Diversification Across Asset Classes

In the wild and unpredictable world of finance, diversification is key. Think of it like your movie collection: you wouldn’t want to watch only one genre, right? Sheffield Financial advises investors to spread their investments across various asset classes. Consider tech stocks like Microsoft alongside sustainable stocks like NextEra Energy. This mix can help soften the blows during market turbulence, much like revisiting a favorite classic to boost your spirits!

2. Embracing ESG Investments

Environmental, Social, and Governance (ESG) issues have taken center stage in investment circles. Just as you might cheer for your favorite hero in a cinematic adventure, you can also back companies that prioritize sustainability. Tesla has been a trailblazer in this arena, wooing investors with their commitment to eco-friendly practices. Sheffield Financial encourages adding funds focused on green companies to your investment lineup, connecting profit with purpose.

3. Real Estate Investment Trusts (REITs)

Let’s be real: real estate is like that iconic blockbuster that never goes out of style. Sheffield Financial shines a light on Real Estate Investment Trusts (REITs), such as American Tower and Prologis. These investments have shown potential for solid income streams and property value growth. With interest rates stabilizing, now could be a prime time for tapping into the real estate market’s magic, particularly in commercial sectors.

4. Utilizing Index Funds for Long-Term Stability

For those looking for a steady ride with their investments, Sheffield Financial suggests opting for index funds. Think of it as watching a cozy, feel-good film: you know what to expect, and it rarely disappoints. Funds like the Vanguard S&P 500 ETF offer broad exposure to the market without the high fees of actively managed options. This laid-back investing style allows your portfolio to bloom over time, making it a popular choice for long-term stability.

5. The Rise of Cryptocurrency Investment

You’d have to be living under a rock to miss the rise of cryptocurrencies like Bitcoin and Ethereum. Sheffield Financial takes a moment to explore these digital currencies. Just as movie franchises can soar to great heights, crypto can deliver jaw-dropping returns. Platforms like Coinbase and Binance provide the security you need to dabble in this volatile but exciting field. Just remember, a small allocation in crypto can potentially pay off like a surprise plot twist!

6. Focus on Health Tech Investments

You can almost hear the trumpets of a new superhero franchise playing in the background when we talk about health tech. The pandemic brought forth a wave of innovation, and companies such as Teladoc Health and Moderna are leading the charge. Sheffield Financial sees massive growth potential in this industry as it evolves. Investing here can feel like being part of a groundbreaking origin story, allowing you to champion companies driving change.

7. Exploring Peer-to-Peer Lending Platforms

Looking for something a bit different? Sheffield Financial shines a light on peer-to-peer (P2P) lending platforms like Prosper and LendingClub. They provide a new avenue for earning income by connecting borrowers directly with individual lenders. It can generate attractive returns, but like a nail-biting suspense thriller, there are risks involved. Always evaluate carefully your appetite for risk before jumping in!

Understanding the Risks of Innovative Investment Strategies

Even the most thrilling films have their plot twists, and investing is no exception. While Sheffield Financial’s strategies hold promise, the risks are real. The dynamic nature of global markets means things can change on a dime. Understanding your risk tolerance is crucial before diving in.

Monitoring economic indicators and trends can be the key to making smart moves. Keeping an eye on the market is like binge-watching a series: the more you know, the more enjoyable it becomes. Regularly assessing your portfolio will keep your financial adventure from turning into a horror flick!

Innovating Personal Investment Approaches

Just as directors continue to innovate their storytelling techniques, investors must adapt to ever-changing market conditions. Sheffield Financial encourages a mindset of learning and refining strategies. As technology opens doors to investing, 2026 promises to be a transformative year.

By embracing effective tools and diversifying your portfolio, you can build financial resilience. Whether you’re just starting out or have years of experience, the sky’s the limit for your investment dreams. So grab your metaphorical film slate and find your unique angle in the vast financial landscape!

So there you have it! Sheffield Financial’s stellar investment strategies are like the characters from your favorite films—complex but fascinating. Whether you’re a seasoned investor or just starting to explore, these strategies will help you navigate the exciting world of finance. And who knows? Maybe your next big investment will yield blockbuster-level returns!

For more captivating stories and insights, swing by Cinephile Magazine!

Sheffield Financial: Insights on Exceptional Investment Strategies

A Peek into Sheffield Financial’s Philosophy

Sheffield Financial has built a reputation for helping investors chart a course through the often-bumpy terrain of finance. Their strategies aren’t just about numbers; they focus on relationships and understanding clients’ unique needs. Interested in memory? Sheffield’s experts emphasize how understanding past financial trends can shape future decisions. It’s like using a hairbrush—when you find the right tool for your hair type, the results are so much better!

But what makes Sheffield Financial stand out? One interesting fact is that they employ what some might call a ‘ pinstripe approach’ to investment, blending classic strategies with innovative twists. This method not only allows for sustained growth but also caters to those investors looking for something different. Did you know that Buffalo, NY, has some of the safest cities in the U.S.? Sheffield Financial often highlights the significance of investing in secure locations, making them a crucial part of their investment strategies.

Thriving Amidst Change

Adapting to change is critical in the financial sector, and Sheffield Financial understands this like a breath of fresh air. They make a habit of staying ahead of industry trends, helping clients navigate shifts that could impact their portfolios. The investment landscape can sometimes feel overwhelming, much like selecting the perfect outfit for a retro glamour event; it’s all about knowing what works for you.

Moreover, the company emphasizes long-term planning, reminding clients that just like a good movie, great investments don’t always pay off immediately. They focus on building strategies that withstand the test of time. Just think of iconic films featuring characters like Harry; they may not be everyone’s favorite, but their storylines resonate and stick with you. In the same way, Sheffield Financial wants their investment decisions to have lasting effects, delivering returns that hold strong even in challenging times.

Ultimately, Sheffield Financial isn’t just another player in the finance game. They’re here to explore innovative pathways, providing clients with exceptional strategies that pave the way for financial freedom. With their forward-thinking methods and emphasis on building lasting relationships, it’s clear they’re keeping the best interests of their clients at heart—much like ensuring you’re always climate-ready in the safest cities!

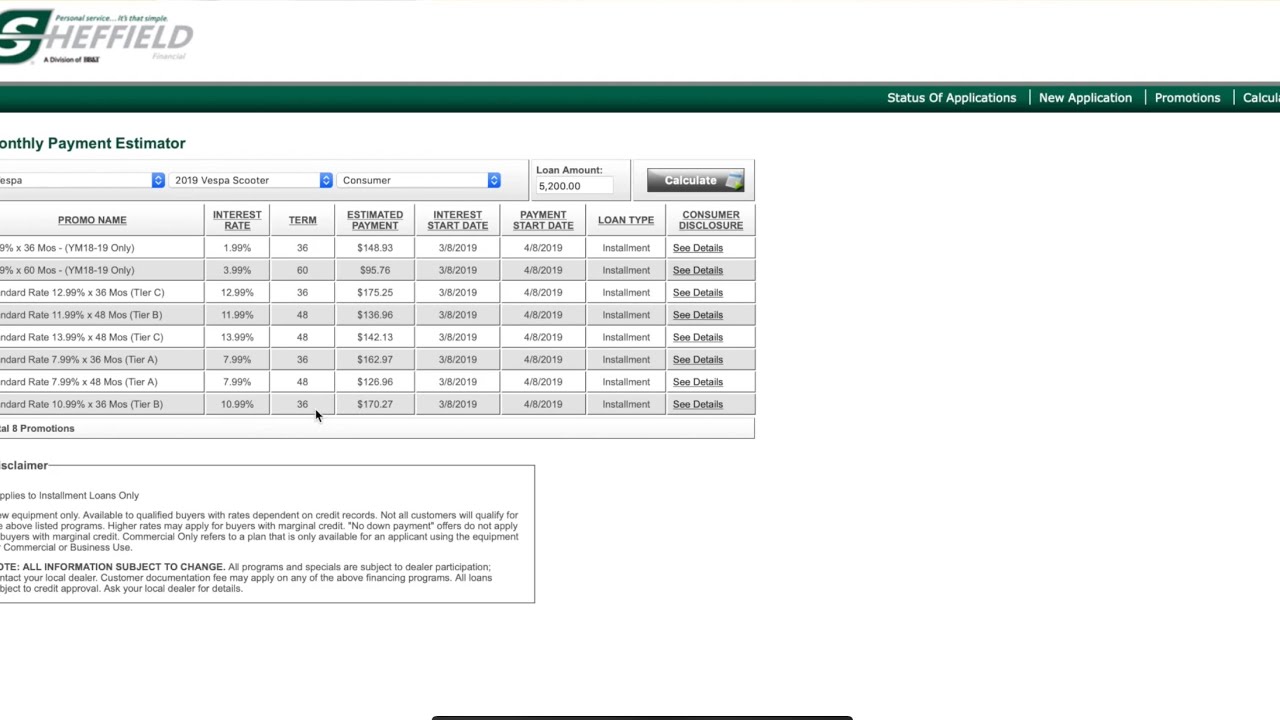

What credit score do you need for Sheffield Financial?

For Sheffield Financial, you’ll generally want a credit score of at least 600 to get considered for a loan, but having a higher score can help with your chances.

What is the phone number for Sheffield Financial 24 7?

You can reach Sheffield Financial 24/7 at their customer service number, which is typically listed on their website or loan documents.

Is it hard to get a loan through Sheffield?

Getting a loan through Sheffield isn’t super hard, especially if you’ve got decent credit or a steady income, but it depends on your individual situation.

Who is Sheffield Financial owned by?

Sheffield Financial is owned by the Bank of North Carolina, which helps provide the funds for their loans.

Can you get finance with a 500 credit score?

With a 500 credit score, it can be tricky to get financing through Sheffield, but it might not be impossible if you can show a good income or other stable financial factors.

What credit score do I need to get 20,000?

To secure a loan of around $20,000, you’d usually need a credit score in the 650 range or higher to improve your chances of approval.

How long can you skip a payment with Sheffield Financial?

Sheffield offers the option to skip a payment, but it typically depends on your loan agreement; often, this can be done once a year or per your contract terms.

What bank does Sheffield Financial use?

Sheffield Financial often works with the Bank of North Carolina for their lending needs, which helps streamline their loan processes.

How to pay off a Sheffield loan?

You can pay off a Sheffield loan by sending in payments via their online portal, phone, or by mailing a check, whatever works best for you.

Does Sheffield offer 0 financing?

Sheffield does offer 0% financing on some of their loans, but it’s usually tied to specific promotions or for certain types of equipment.

Where can I easily get approved for a loan?

To easily get approved for a loan, check out credit unions or banks that focus on personal loans, as they often have friendlier criteria.

How quickly does a loan get approved?

Loan approvals with Sheffield can happen pretty quickly, sometimes within a day or two, depending on your application details.

How to get approved through Sheffield Financial?

To get approved through Sheffield Financial, make sure your credit score is strong and gather your income documents to submit with your application.

How long can you finance an UTV?

For financing a UTV, Sheffield typically allows terms ranging from 36 months to 72 months, tailored to the amount borrowed.

What services does Sheffield Financial provide?

Sheffield Financial provides services like personal loans, financing for outdoor equipment, and retail financing, making it easier to acquire what you need.

What is the minimum credit score to be approved?

The minimum credit score for approval with Sheffield is around 600, but keep in mind that specific loans may have different requirements.

What does conditionally approved mean in Sheffield Financial?

If you’re conditionally approved with Sheffield Financial, it usually means they need additional information or documentation before finalizing the loan.

What is the minimum credit score for finance?

In general, the minimum credit score to get financed can be around 600, but higher scores often lead to better terms and interest rates.

What’s the lowest credit score to finance a car?

If you’re looking to finance a car, most places will want to see a credit score of at least 600, though some may consider lower scores depending on your overall financial situation.